Oba Otudeko, the owner of Honeywell Group, has become the largest shareholder of First Bank of Nigeria Holdings (FBNH) Plc, following a cross deal worth N87.8 billion. Otudeko purchased 4,770,269,843 shares at a rate of N19 per unit, making it the largest volume of First Bank shares traded in a single day since 2012. This acquisition brings Otudeko’s shareholding in the bank to 14% of its outstanding market value.

A disclosure of shareholding sent by Honeywell Group Limited’s affiliate, Barbican Capital Limited, notified FBN Holdings of the acquisition. In response, FBN Holdings acknowledged the transaction, stating that Barbican Capital Limited now holds a 13.3% equity stake in the company.

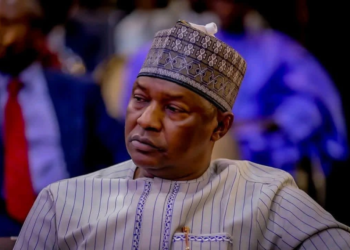

Analysts highlight that Otudeko, the former chairman of First Bank until 2019, has made a swift comeback as the bank’s largest shareholder. In 2021, billionaire Femi Otedola became the bank’s largest shareholder after a power struggle with Hassan Odukale. However, with Otudeko’s recent acquisition, Otedola drops to second place with a 9% shareholding.

This move indicates Otudeko’s strong bid for control of First Bank of Nigeria Holdings, positioning him as a major player in the battle for the bank’s leadership. Other significant shareholders include Hassan Odukale, Mike Adenuga, and Saheed Arisekole.

Earlier in May 2022, Otudeko sold Honeywell’s shares worth N22 billion to repay a long-standing debt to FBNH. The recent acquisition by Otudeko demonstrates his desire to build a business that better serves Nigerian customers.

The sale of Honeywell Flour Mills to Flour Mills of Nigeria Plc also contributed to Otudeko’s financial gains. Flour Mills of Nigeria acquired a 71.69% stake in Honeywell Flour Mills, with Otudeko earning N22.24 billion from his stake in the deal. This transaction marks Otudeko’s final attempt to unlock value from his Honeywell Flour Mills stake, following challenges faced as Chairman of First Bank of Nigeria Holdings.

The journey toward the sale and purchase of Honeywell Flour Mills began in 2021 when Otudeko faced troubles related to alleged underhand deals as Chairman of the First Bank board of directors. The Central Bank of Nigeria subsequently removed him and others from the board, ordering Honeywell Flour Mills to repay a loan taken from First Bank within 48 hours. Otudeko maintained that Honeywell had consistently serviced its loan obligations.

With these recent developments, Otudeko solidifies his position as a prominent figure in Nigeria’s business landscape.