The Federal Competition and Consumer Protection Commission (FCCPC) has taken a stand against the implementation of recently announced price hikes for PoS (Point of Sale) transactions by PoS operators in Nigeria.

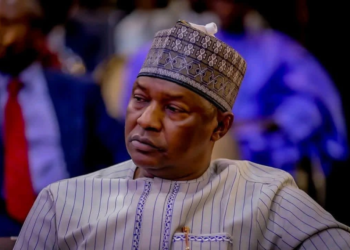

In a statement released on Wednesday, Mr. Babatunde Irukera, the Chief Executive Officer of FCCPC, emphasized that the Federal Competition and Consumer Protection Act (FCCPA) prohibits any trade group from fixing prices in a manner that could distort the market. Irukera cautioned the Association of Mobile Money and Bank Agents in Nigeria (AMMBAN) against proceeding with the proposed price increases, stating that any attempts to do so would be met with penalties as outlined in the FCCPA.

Irukera highlighted that the FCCPA strictly opposes price fixing by trade groups in Nigeria. He stated, “While the FCCPA recognizes and encourages the formation of trade associations for legitimate purposes such as upholding standards and best practices, it significantly limits the extent of collaboration, particularly when it comes to the pricing and provision of services.”

The FCCPA explicitly forbids price-fixing agreements among undertakings, whether bilateral or multilateral, or any coordinated efforts by undertakings acting collectively under the umbrella of an association to set prices, coordinate supply, or engage in any other activities that could significantly hinder competition or distort the market.

Although it is commendable for professionals or businesses within a trade association to aspire to prevent fraud, excessive pricing, or unjust practices, Irukera emphasized that price fixing is not an acceptable or proven method to achieve these goals. On the contrary, it distorts the market, impedes innovation and efficiency, and ultimately fails to benefit consumers or other businesses, except for those involved in such illegal collaborations.

The FCCPA imposes severe penalties for cartels or any form of coordinated or collusive behavior among competitors, including at the association level. The Commission is committed to enforcing the law to its fullest extent whenever there is sufficient evidence of prohibited conduct or arrangements, both directly and indirectly.

To ensure that AMMBAN’s statement accurately represents the situation and is not misleading, the Commission is launching an investigation. If evidence proves that the statement is factually correct, appropriate regulatory measures will be taken to address the conduct.

Irukera urged consumers to provide valuable and credible information that can assist in the investigation and enforcement processes.

Last Friday, the Association of Mobile Money and Bank Agents in Nigeria (AMMBAN) made an announcement regarding a unified pricing structure for PoS operators in Lagos. Stephen Adeoye, the spokesperson for AMMBAN’s Lagos Chapter, revealed the details of the standardized price list for PoS transactions during an interview on Channels TV.

Adeoye explained that for withdrawals ranging from N1,000 to N2,400, a service charge of N100 would apply. Withdrawals between N2,500 and N4,000 would incur a fee of N200. As for withdrawals from N4,100 to N6,400, customers would be charged N300, while the fee for withdrawals between N6,500 and N7,900 would be N400. Withdrawals from N8,000 to N10,900 would carry a service charge of N500.

Additionally, Adeoye stated that withdrawals from N11,000 to N14,400 would be subject to a service fee of N600, while withdrawals between N14,500 and N17,900 would incur a charge of N700. Finally, withdrawals in the range of N18,000 to N20,000 would be charged N800.