Shell investment in Nigeria

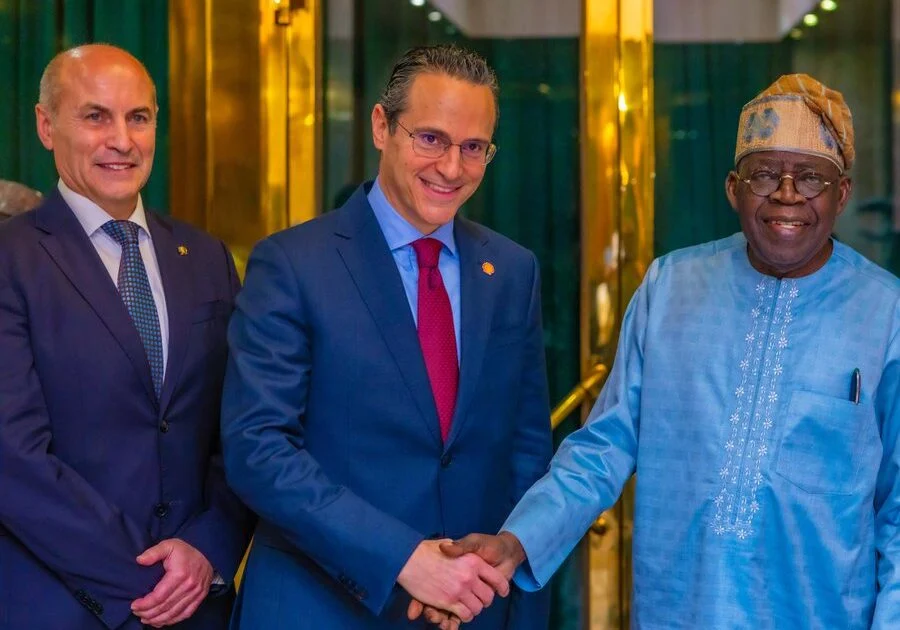

Nigeria’s long-strained relationship with international oil majors may be entering a critical reset, as Shell Global’s Chief Executive Officer publicly praised President Bola Ahmed Tinubu’s leadership and vision, revealing that the oil giant is considering up to $20 billion in new investments in Nigeria’s oil and energy sector.

The statement, delivered during high-level engagements with Nigerian officials, signals one of the strongest endorsements yet of Tinubu’s reform agenda from a major multinational energy company. Coming after years of divestments, regulatory disputes, and declining investor confidence, Shell’s renewed interest underscores a potential turning point in Nigeria’s quest to reclaim its status as Africa’s premier energy investment destination.

At the heart of the message was a clear theme: Tinubu’s leadership and policy direction are reshaping investor perception of Nigeria’s energy sector,Shell investment in Nigeria.

Why Shell’s Statement Matters

Shell’s renewed interest is not just symbolic. For over a decade, the company has been gradually retreating from Nigeria’s onshore oil operations, selling assets amid security challenges, environmental liabilities, and regulatory uncertainty. The decision by Shell to now consider a $20 billion energy investment in Nigeria marks a sharp contrast to that earlier posture.

According to industry analysts, Shell’s comments suggest that Nigeria’s investment climate is being reassessed at the highest levels of global energy decision-making.

Shell Global’s CEO specifically cited Tinubu’s leadership, reform clarity, and commitment to energy transition as key drivers behind the company’s renewed confidence. This places Nigeria firmly back on the radar at a time when global energy capital is increasingly selective,Shell investment in Nigeria.

Tinubu’s Energy Reforms Under the Spotlight

Since assuming office, President Tinubu has pursued aggressive reforms across Nigeria’s economic and energy landscape. Central to this effort has been the full operationalisation of the Petroleum Industry Act (PIA), which aims to provide fiscal certainty, transparent governance, and investor-friendly frameworks for oil and gas operations,Shell investment in Nigeria.

Industry insiders note that Tinubu’s willingness to engage directly with international energy firms has helped rebuild trust that was previously eroded.

Shell’s endorsement suggests that Tinubu’s leadership is translating policy promises into signals investors can act upon. From streamlining regulatory bottlenecks to clarifying gas development priorities, the administration has pushed Nigeria’s energy sector toward predictability,Shell investment in Nigeria.

https://ogelenews.ng/shell-investment-in-nigeria-tinubu-20bn-energy

What a $20bn Investment Could Mean

If realised, a $20 billion energy investment in Nigeria would rank among the largest single inflows into the country’s oil and gas sector in recent history. Analysts say such funding could span:

• Offshore deepwater oil production

• Gas infrastructure development

• LNG expansion and gas-to-power projects

• Energy transition initiatives, including carbon reduction technologies

Shell’s renewed interest aligns with Nigeria’s ambition to leverage its vast gas reserves as a bridge fuel while sustaining oil output for fiscal stability.

For the Nigerian economy, this scale of investment would mean jobs, foreign exchange inflows, technology transfer, and improved production capacity,Shell investment in Nigeria.

Rebuilding Nigeria’s Global Energy Reputation

Nigeria has struggled in recent years to compete with emerging oil provinces such as Guyana, Namibia, and Brazil. Investors have often complained of policy inconsistency, security risks, and community tensions.

Shell’s public praise of Tinubu’s leadership and vision offers a reputational boost that goes beyond the company itself. Energy experts say multinational endorsement often influences broader investor sentiment, especially in capital-intensive sectors like oil and gas.

“This is not just about Shell,” said an Abuja-based energy analyst. “When Shell speaks this openly, other majors listen.”

Niger Delta Implications

While Shell’s future investments are expected to focus largely on offshore and gas projects, communities in the Niger Delta remain attentive. Past grievances over environmental damage and host community relations have shaped public perception of oil majors.

The Tinubu administration has pledged to ensure that new investments align with community development frameworks under the PIA, including host community trust funds.

Observers say any renewed Shell investment will be closely watched for how it balances profitability with environmental responsibility and social impact,Shell investment in Nigeria.

A Signal to Global Markets

Shell’s statement comes at a time when Nigeria is actively courting foreign capital across sectors. The administration has framed energy investment as central to economic recovery, fiscal stability, and industrial growth.

By openly crediting Tinubu’s leadership for Shell’s renewed interest, the company has effectively sent a message to global markets: Nigeria may once again be open for serious energy business.

Whether the $20 billion materialises in full remains to be seen, but the signal alone has already shifted the narrative,Shell investment in Nigeria.

Looking Ahead

Nigeria’s challenge now lies in sustaining reform momentum. Investors will be watching how regulatory agencies act, how security concerns are managed, and whether policy consistency endures beyond announcements.

For Tinubu’s government, Shell’s endorsement represents both validation and pressure. Validation that reforms are working, and pressure to ensure promises translate into long-term stability.

As global energy dynamics evolve, Nigeria’s ability to retain and grow investor confidence will depend on execution, not rhetoric.

Shell’s message suggests that, for now, the world’s energy giants are watching Nigeria again,Shell investment in Nigeria.